The Umbrella Project

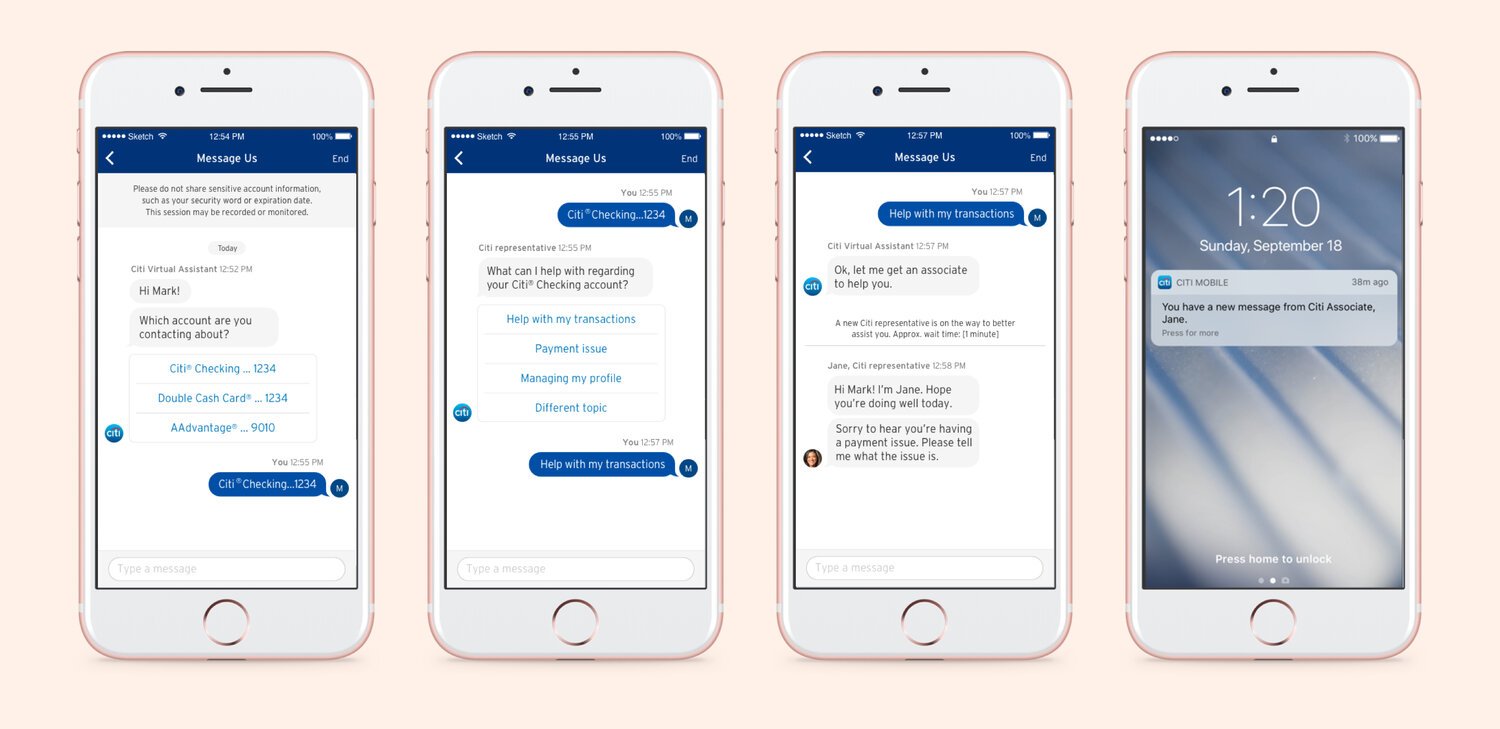

Messaging “Chat 2.0” is Citi’s new communication channel that offers an omni-channel messaging experience, combining “Live Agent” support with AI-powered bots, allows Citi customers to receive assistance anytime, anywhere, and through their preferred platform, making customer service more flexible and accessible.

My role

UX designer

Duration

4 months

Time

2018

Platform

iOS

Background

Our current system only offers the bowser experience at section base with all conversation as individual action. In 2018, we are aiming to provide asynchronous conversation on the mobile platform, that empowers agents to research user questions and provide a detailed and informed response in a timely manner. Ideally this should allows customers to see a history of their communication with the contact center.

The target use case require Citi to know who the customer is before servicing, ensure that PII is passed over appropriately when going to a live agent OR ensure a customer unique identifier is passed over to Bot for appropriate connection to back-end services.

Project goal

The focus is on cross-device messaging with a live agent with integration of Chat Bots to answer simple customer queries.

Increase in customer satisfaction NPS

Reduction in IVR volume

Reduction in support costs

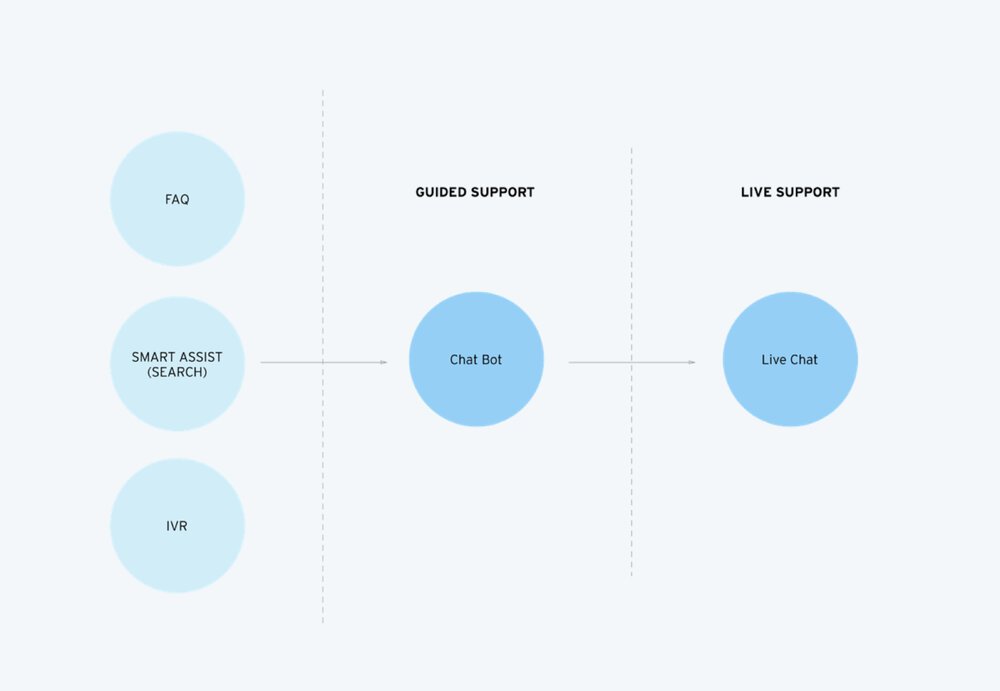

Digital Customer Care Umbrella

We held 5 areas of customer support to connect FAQ, Smart Assist and IVR to be the source of Chat Bot scripts.

Problem statement

Customers want to get their questions answered across devices and on their own time, rather than being dependent on phone/IVR or a real-time chat session.

Solution

Generalist Bot

Answer simple queries, use Chat Bot to determine intent and answer simple queries in a personalized, concise and complete way. Proposed use cases includes: intent gathering and bank account routing.

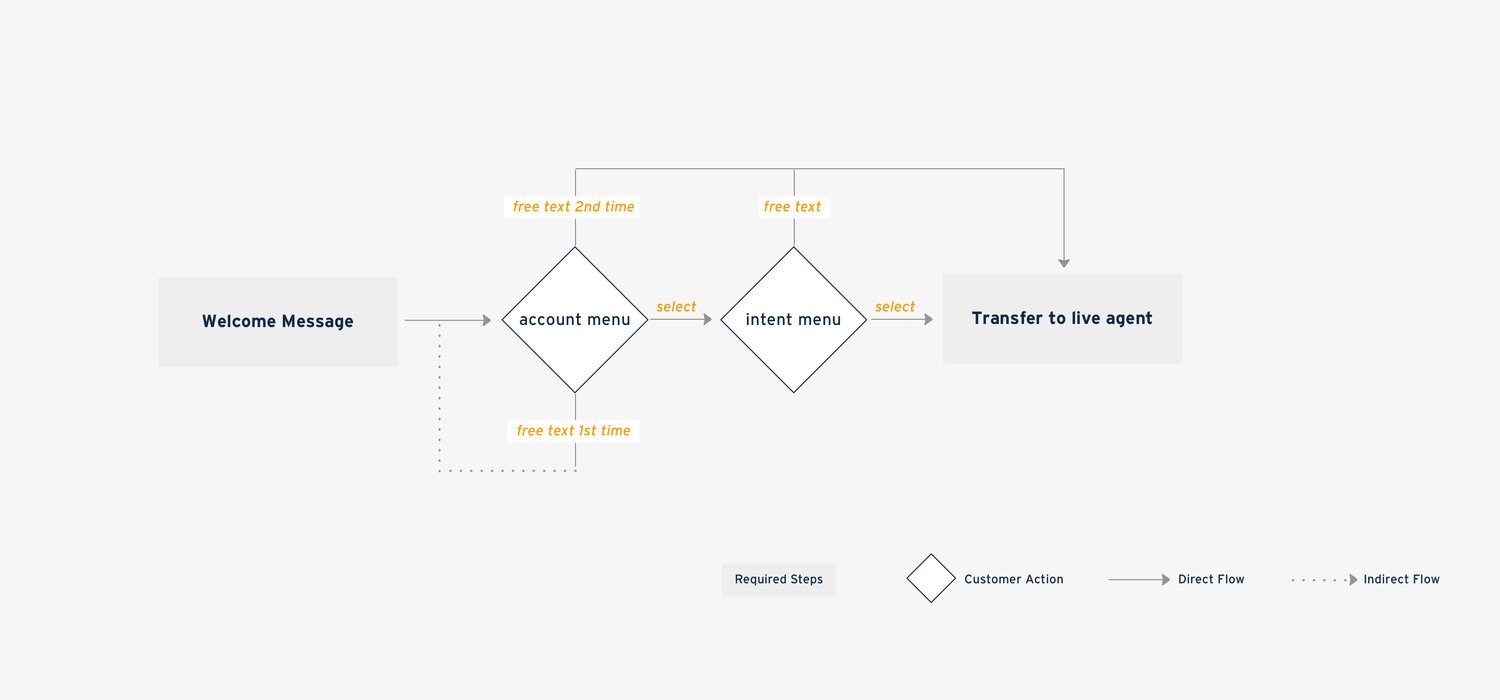

User Flow

In order to better understand the project scope and feasibility, the design process start from white-boarding. The workshop was lead by the design team and work with product owner and strategist to define happy path for the user flow, as well as the potential edge scenarios.

Conceptual Testing

Reward and FAQ Journey

We have brought the onboarding flow and conceptual messaging experience to moderated in person testing with our research partner to explore the behaviors, actions, and emotions that customers associate when they interact with the Bot.

The objective is to understand how citi customers would engage with citi messaging agents from an omni-channel, desktop to mobile, perspective. Result shows all candidates values the mobile platform.

Wireframe

Userflow

Multi - Relationship Customer and Dynamic Intent Routing

UAT Feedback

Across April 10th – May 26th, 2018. Total 2,294 queries has been tested throughout our internal Fintech team. With 437 total session executed, a session is defined as back-and-forth messages between the user and Citi Bot with less than 15 minutes idle time by the user.

The result show over 85% of users felt that the Citi Bot experience was good or excellent, while 75% believe they would use Citi Bot once available.

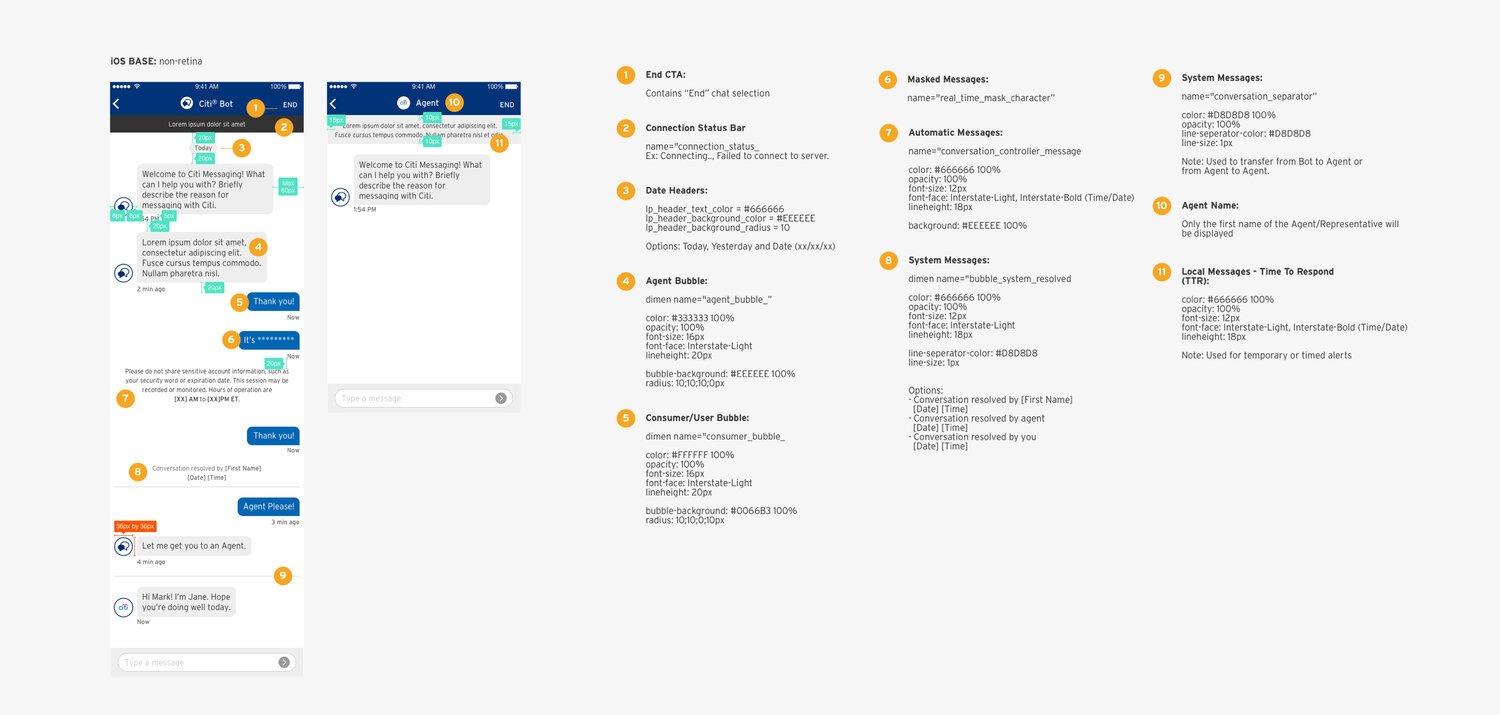

Style Guidance

Impact

15% of Citi live rep volume were deflected to bot, lower interactions of AHT on Messaging conversations.

70% of consumers prefer Messaging over calling for customer support.

Achieved NPS at 13.92, is a good marker of how users reacted to the experience.

(At scale of 0-10, How likely are you to recommend Citi Bot to a friend or family? )Top intention matched with conceptual testing.

Transactions & Spending at 32%, FAQs at 29% and Account Balances at 12%